Return on Investment is one of the most important financial metrics used in business. It is used to measure the probability of gaining a return from an investment. Furthermore, it is a ratio (even though it is often expressed as a percentage) that compares the gains or losses compared to the costs of the investment. The bigger the gains or profit, the better is the investment.

ROI is useful, and many companies are calculating it as it helps evaluate the possible return one will make from an investment.

This is a key metric, and businesses use it to rank the attractiveness of different investment opportunities and calculate the most profitable one.

It is a widely used metric, and it is a standardized measure of profitability anywhere, in any industry and in any market. However, a disadvantage is that it doesn’t account for how long the investment is held in the holding period, especially if it is calculated at its most basic form, that is, by just looking at profits and costs.

When is ROI used?

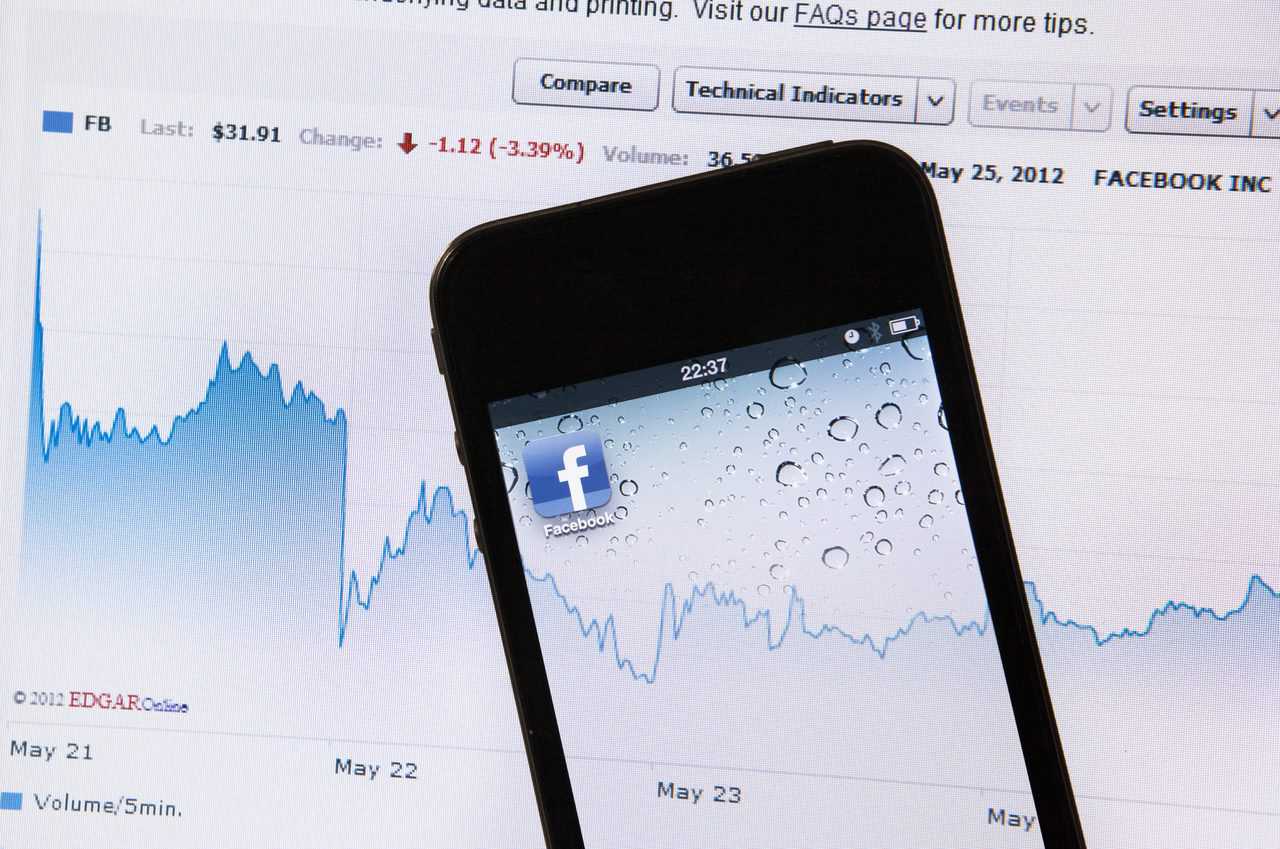

ROI is used in many different applications. Companies can use it to measure the profitability of a stock and should they invest in it. It is also used to decide whether to purchase a business to ensure it will be a profitable purchase, or even to check the most profitable segment of a marketing campaign. It can be used in a variety of ways.

How to calculate it?

How to calculate it?

To calculate the return, you need to subtract the initial value of the investment from the final value of the investment. This is equal to the net return. Then, use the new number, or the net return, and divide this new number by the cost of the investment. Lastly, multiply the number by 100.

Naturally, the next step is to interpret the results. As we mentioned before, it is usually expressed as a percentage, mostly because percentages are easier to understand. Also, the net return and the final number can either be positive or negative.

When the final number is positive, it means that the net returns are exceeding the total costs. If it is negative, it means the total costs will exceed total returns, which means the investment is not profitable and will create losses.

Let’s do this step by step, and let’s say we will calculate the returns of 100 shares we would buy in a company. To be able to calculate the net returns, we need to include total returns and total costs. In this case, the returns come from the capital gains and dividends, while costs would include the initial purchase price and any commissions you need to pay to be able to trade the shares.

Let’s do this step by step, and let’s say we will calculate the returns of 100 shares we would buy in a company. To be able to calculate the net returns, we need to include total returns and total costs. In this case, the returns come from the capital gains and dividends, while costs would include the initial purchase price and any commissions you need to pay to be able to trade the shares.

Let’s say you want to buy 100 shares of a company at $5 per share. Then, two years later, you sell them to an investor for $10 per share. The investor earned $200 from dividends and spent $100 on trading commissions to be able to buy and sell the shares.

The ROI will be calculated like this:

ROI= (($10 -5) * 100 + 200 – 100) / (5 * 100)) * 100 = 120%

This means you have earned a return of 120% on your initial investment.

What about other uses of the ROI?

In the previous case, we used an example of an investment in buying stocks to show the rate of return. However, ROI can be used to calculate a lot more. You can use ROI to calculate the rate of your returns of a marketing campaign you are doing. The simplest way is to include the ROI of your marketing campaign into the overall business calculation.

For example, take the sales growth from the product, subtract marketing costs, and divide by the marketing costs. Let’s say the sales were $100 and the marketing campaign $50, and then the ROI is 100%. This is a pretty easy way of calculating ROIs.

What is a good ROI?

Basically, a good ROI is something that generates a profit. In the case of a marketing campaign, it is something that generates more sales for less cost and yields a higher profit. However, there is no one answer to what percentage is good or bad. Someone might be happy with a 10% ROI, while someone is chasing a higher number of 30%. It all depends on the company and the industry you are in, so you need to do a lot of analysis to be able to know if your strategy is paying off.

ROI can be calculated in several ways; that is, one company might include external factors while another company might not.

These external factors are taxes, inflation, and time. A third company might include the customer lifetime values, the total revenue, the monthly recurring revenue, or the customer acquisition cost, while a different company might include just the total revenue and total costs.

However, there is no one answer to this, and no one can know the rate of return at the beginning of the campaign or before the investment has been made. Basically, everyone has to go through stages of trial and error and measurement before one can know what has worked for them, and if the company should continue with this strategy.

How to increase ROI?

Naturally, the goal is to increase your ROI. You want to find strategies that work well, and that increase the return on the investment. This means you will have to analyze everything and see what strategies brought in the most leads, most customers, and generated the highest sales. This means you need to see if your Facebook ads are better or if your email marketing generated better leads, so you know where you need to invest more money.

Conclusion

In short, ROI should be seen as one of the most important metrics, and it should be done multiple times throughout the year. It is the best way to see what has been working for you and generating profits, and what strategies you need to abandon or change. That is why we recommend you spend some time analyzing and learning about all the factors you need to think about when calculating your ROI.